EO: The Specialized Data Layer Powering On-Chain Credit

With the launch of mF-ONE, Fasanara Capital, Midas & EO have set a new precedent for real-world asset integration. This initiative goes far beyond traditional tokenization; it introduces a comprehensive framework for compliant, composable and data-verifiable institutional products on-chain. Here’s how it works…

Introducing Fasanara Capital; Institutional Asset Management -Fasanara Capital is an institutional asset manager pioneering fintech lending, alternative credit and digital assets through a proprietary technology platform that connects with 141 fintech lenders across 60+ countries. With over $85 billion in traded volumes and $4.5 billion in assets under management, Fasanara delivers innovative, ESG-aligned investment solutions; from trade receivables and real estate-backed loans to tokenized money market funds, designed to close funding gaps for SMEs and promote global financial inclusion.

Midas; the TradFi-DeFi Bridge -

Midas is a tokenisation platform that bridges traditional finance and decentralized finance by issuing tokenized certificates linked to real-world financial instruments, such as short-duration U.S. Treasuries. Through its Liquid Yield Token (LYT) framework, Midas issuing composable tokens that are integrated with leading DeFi protocols, bringing regulated asset exposure into smart contracts. With partnerships involving institutions like Fasanara, BlackRock and integrations with DeFi protocols, Midas aims to make investing accessible, secure and efficient in the DeFi ecosystem.

Midas’ mF-ONE; powered by EO - Diversifying Fasanara’s Portfolio -

The launch of mF-ONE by Midas, an ERC-20 investment certificate providing on-chain exposure to Fasanara Capital's diversified private credit portfolio, marks a significant inflection point for institutional DeFi. This innovation directly addresses the demand for programmable yield from RWAs. Critically, for this breakthrough to achieve its full potential and gain institutional trust, a foundational layer of verifiable data integrity is non-negotiable. This is precisely why Midas and Fasanara Capital have exclusively selected EO Blockchain Oracle as their official blockchain oracle infrastructure partner.By streaming tamper-proof NAV attestations, EO unlocks capital efficiency in the mF-ONE/USDC Morpho Market, where qualified investors can borrow USDC from Steakhouse-curated vaults while retaining exposure to Fasanara's performance.

Dennis Dinkelmeyer | Midas CEO: "eOracle is a team that truly delivers. From our experience collaborating on mF-ONE - our first tokenized private credit asset - we trusted them because they are proactive, fast, and laser-focused. When building at the frontier of innovation, you want a partner like eOracle by your side.”

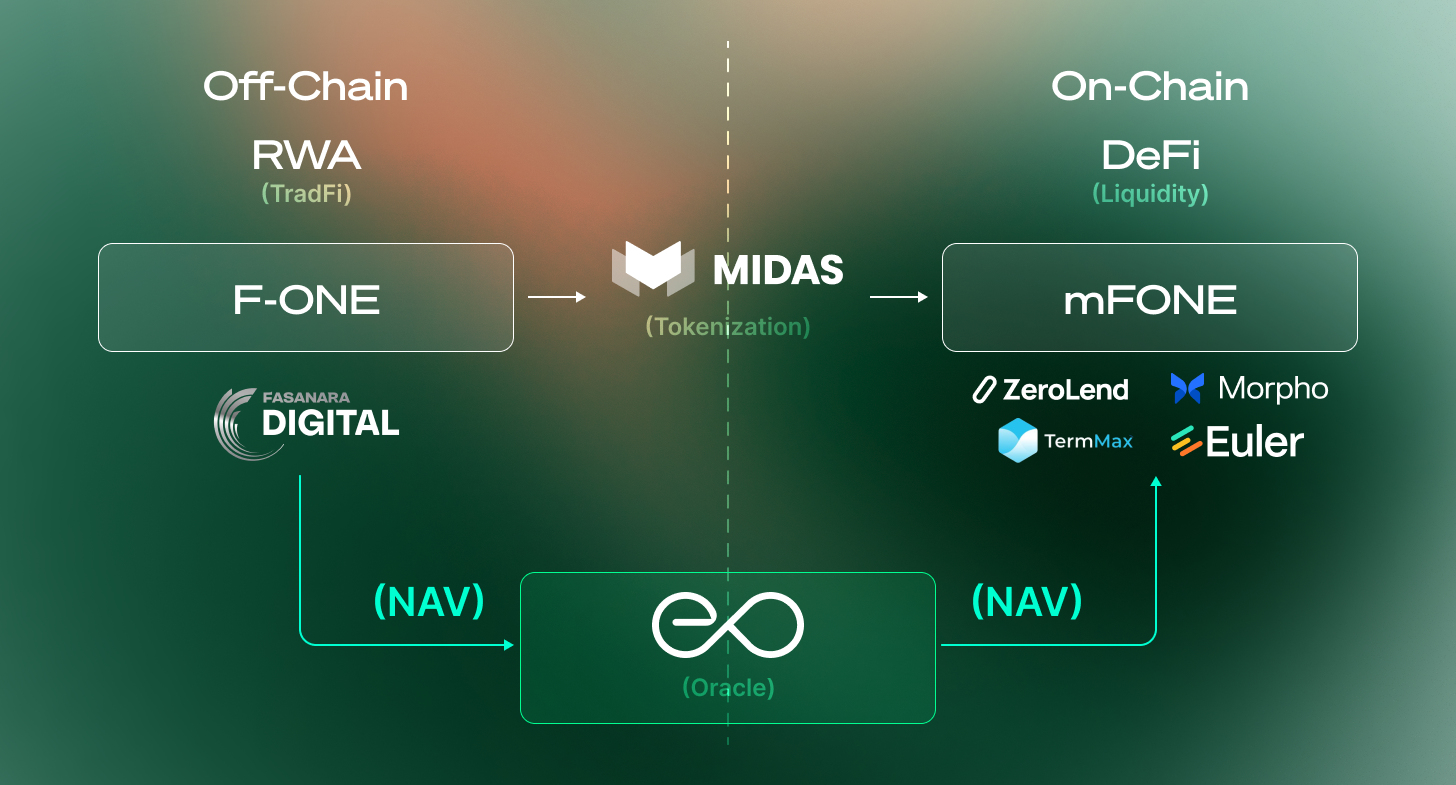

The Framework: A Complete, Composable Value Chain

- Asset Origination — Fasanara Capital

Fasanara F-ONE fund supplies the underlying assets tokenized as mF-ONE. With over 600,000 active credit positions and a diversified portfolio structure, Fasanara brings institutional-grade credit origination to DeFi. - Product Structuring & Distribution — Midas

Midas Issues mF-ONE, an ERC-20 certificate engineered for compliant on-chain exposure and designed to mirror F-ONE's diversified returns, creating secure, regulatory-compliant tokenized structures; transforming traditional assets into programmable digital instruments. - Secure Data Layer — EO

As the secure data layer, EO Blockchain Oracle delivers the verifiable NAV calculations and Proof-of-Reserve attestations for the mF-ONE token. Its institutional-grade security architecture provides the foundational trust and compliance pathways for Fasanara's private credit assets to be securely utilized on-chain. - Liquidity — Morpho

Morpho provides permissioned markets where investors borrow stablecoins against mF-ONE. Their efficient peer-to-peer matching algorithm optimizes capital efficiency while maintaining institutional compliance standards. Morpho's infrastructure enables programmable lending and borrowing with customizable risk parameters, creating a secure venue for institutional participants to access liquidity without compromising on regulatory requirements or asset quality. - Risk Curation — Steakhouse

Steakhouse sets risk parameters and curates vaults, providing expert oversight for institutional-grade risk management. As specialists in on-chain credit risk, they perform continuous monitoring of asset performance, adjust collateralization requirements based on market conditions, and implement sophisticated risk mitigation strategies. Their curator model bridges traditional underwriting expertise with decentralized finance, ensuring that credit quality remains paramount throughout the lending lifecycle.

Why This Blueprint Sets the Institutional Standard

This alliance goes beyond tokenization. It establishes a digitally native trust stack in which:

- Asset quality is proven by Fasanara’s decade-plus performance.

- Data integrity is guaranteed by EO Blockchain Oracle's verifiable feeds.

- Risk oversight is maintained through Steakhouse’s curator model.

- Liquidity is enabled through Morpho's efficient money markets.

- Composability is delivered via Midas-issued tokens that integrate seamlessly with DeFi protocols.

The result is a reproducible model for bringing private credit from spreadsheets to programmable, permissionless finance, without compromising institutional safeguards.

“Institutional DeFi begins with verifiable data. Our RWA-specific blockchain oracle network turns complex, off-chain credit metrics into on-chain facts, so investors can trust what they see, and builders can compose with confidence.” — Yoni Keselbrener, Head of DeFi, EO

Final Takeaway

Tokenizing assets is no longer enough. The next wave of value accrues to ecosystems that deliver end-to-end verifiability. By combining Fasanara’s origination expertise, Midas’s compliant structuring, Steakhouse’s risk curation and Morpho’s efficient markets, with EO Blockchain Oracle as the specialized data layer, mF-ONE demonstrates how private credit can be both decentralized and institution-grade.

→ EO Docs: https://docs.eo.app/docs

→ EO Website: https://eo.app