RWA's: What If Traditional Assets Could Move at the Speed of Digital Innovation?

The efficiency gap between traditional bank transfers and blockchain transactions highlights the fundamental advantages of distributed ledger technology. This contrast demonstrates why bringing traditional financial assets—bonds, real estate, securities—onto these same high-performance infrastructure represents a significant efficiency opportunity. This is precisely what Real-World Assets (RWAs) accomplish, creating a bridge where the $400+ trillion global financial system can begin accessing blockchain's inherent benefits.RWAs are traditional assets converted into digital tokens that exist on blockchain networks. They're not the technology that makes transactions faster—blockchain already does that. Instead, RWAs are the integration point allowing conventional financial assets to tap into blockchain's existing advantages of speed, programmability, and 24/7 operation.

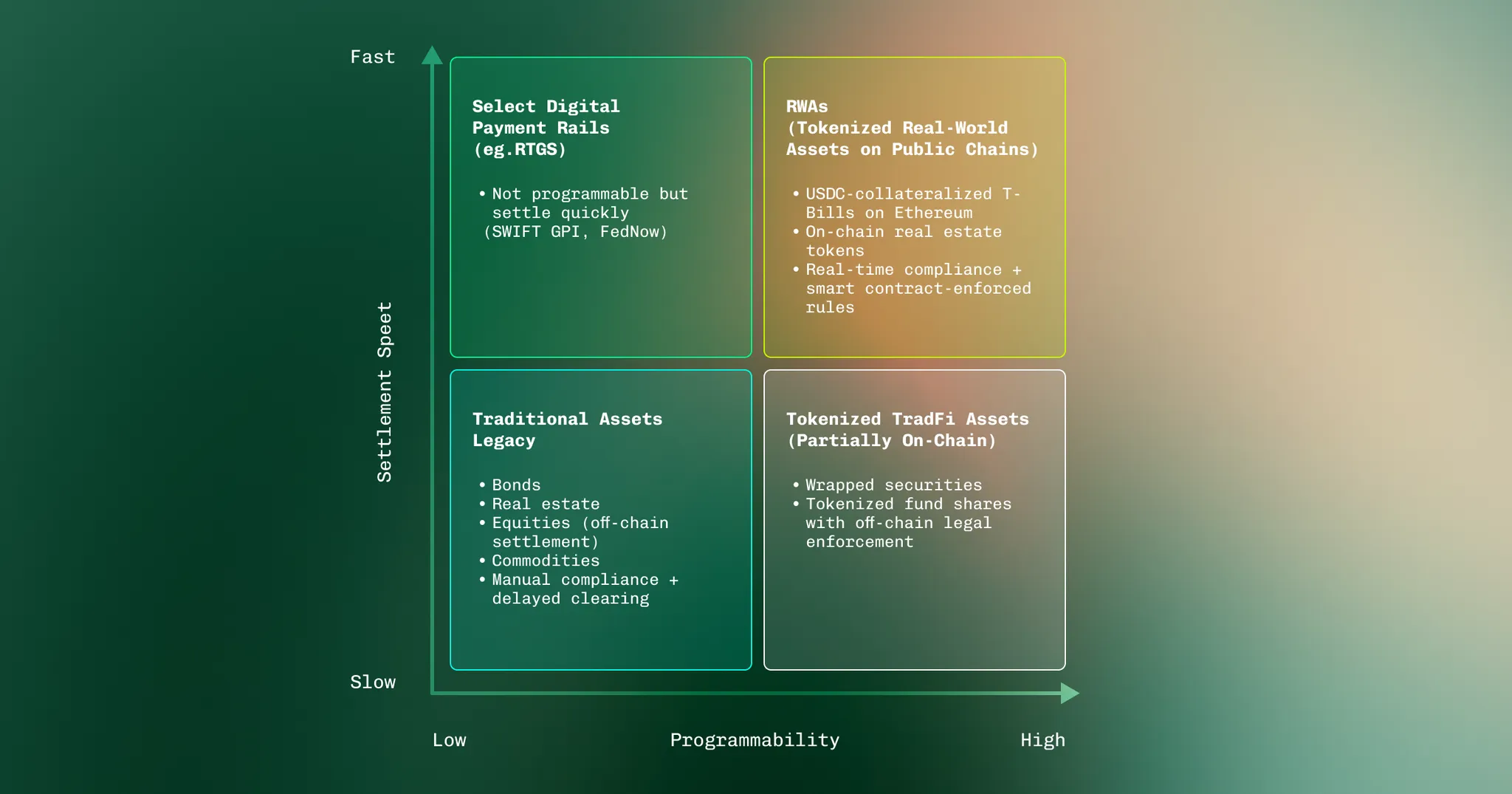

The Evolution of Value: Where Are Your Assets Taking You?

What if Treasury bonds could automatically reinvest their interest? What if real estate ownership could be divided into thousands of pieces, traded instantly, and programmed to distribute rental income without intermediaries? The RWA ecosystem spans across multiple foundational categories:

- Treasury Securities: Government bonds converted into digital tokens (USTB, BUIDL, USYC)

- Private Credit: Loans and trade finance instruments brought on-chain

- Equities: Tokenized stocks and ETFs (bCSPX representing the S&P 500)

- Commodities: Physical goods like gold (PAXG) represented digitally

- Real Estate: Property ownership fractionally tokenized

- Institutional Funds - Investment vehicles like mutual funds and ETFs tokenized for enhanced liquidity efficiency and transparency

While these categories might seem familiar, the capabilities they unlock are anything but conventional. When we tokenize these assets, we're not just changing their form—we're allowing them to access blockchain's programmability, efficiency, and transparency.

The $8 Billion Question You're Not Asking About Your Stablecoins

Current stablecoin holdings represent approximately $210 billion in assets that largely generate no yield, despite Treasury bills yielding around 4%. This represents an $8 billion annual opportunity cost across the market.

We've accepted this financial inefficiency for years, but RWAs are challenging this status quo. When Treasury bonds become tokenized, stablecoin holders can maintain blockchain benefits while earning yields comparable to traditional finance.

But the transformation extends beyond yield capture. RWAs directly address several entrenched market inefficiencies:

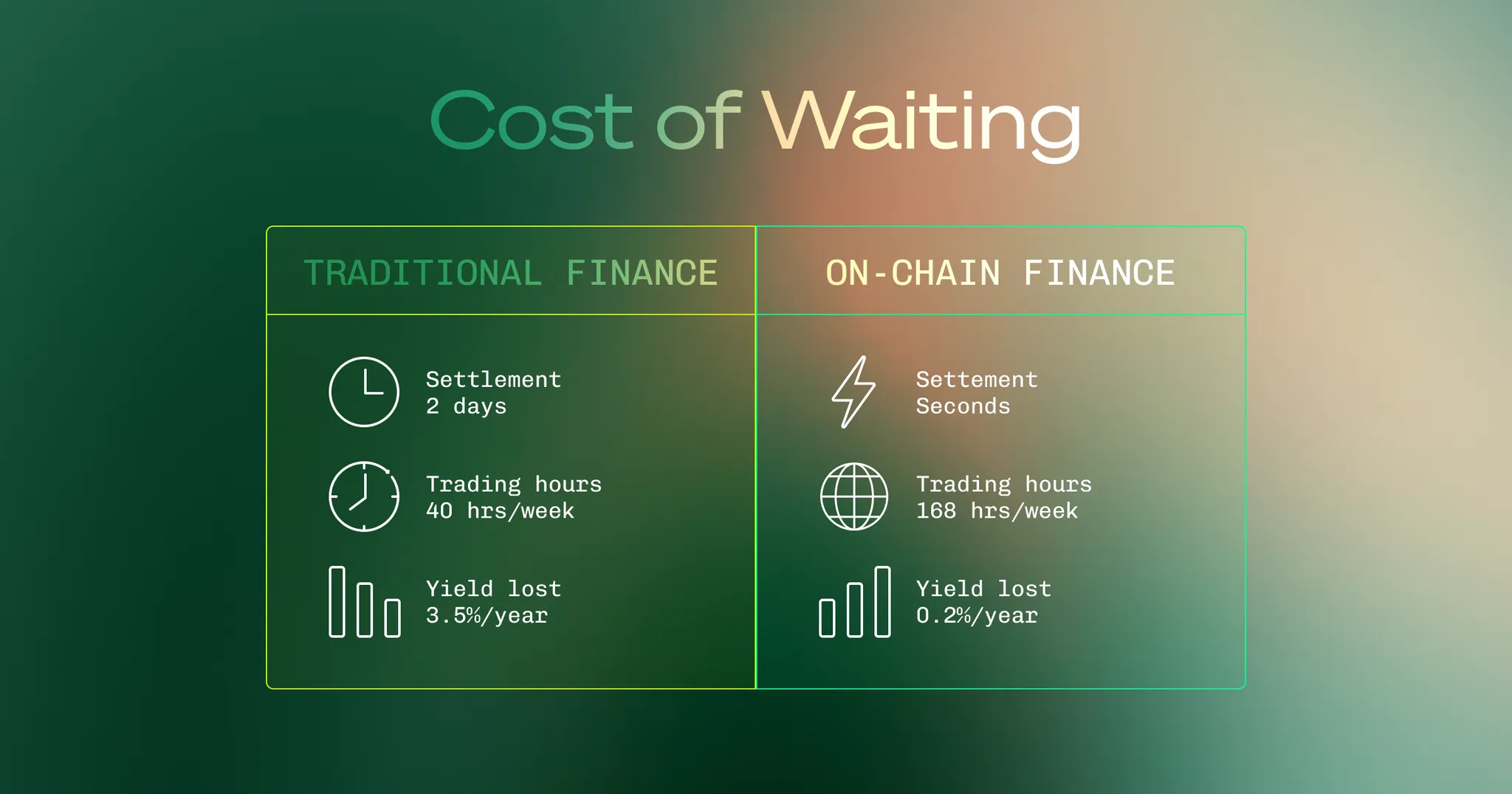

- Time Constraints: Ever wanted to trade but the market was closed? RWAs enable 24/7 trading compared to time-restricted exchanges.

- Settlement Gaps: Traditional markets operate on T+1 or T+2 settlement cycles, while RWAs can settle nearly instantly.

- Access Barriers: High investment minimums have historically locked out everyday investors, but fractional ownership through RWAs allows broader participation.

- Middleman Markup: Each intermediary in traditional finance adds costs—costs that RWAs significantly reduce through automation.

- Funds are locked during settlement windows (e.g., T+2).

- Markets are open ~40 hours/week, so you're missing opportunities when markets are closed.

- All this downtime accumulates into lost yield, especially in volatile or high-yielding environments.

Estimated 3.5% annual yield lost = time capital is idle × potential market/APY returns. In Blockchain RWAs:

- Settlement is nearly instant.

- Markets run 24/7/365.

- Capital is rarely idle, so the missed yield is much smaller — estimated around 0.2% or even less, depending on usage.

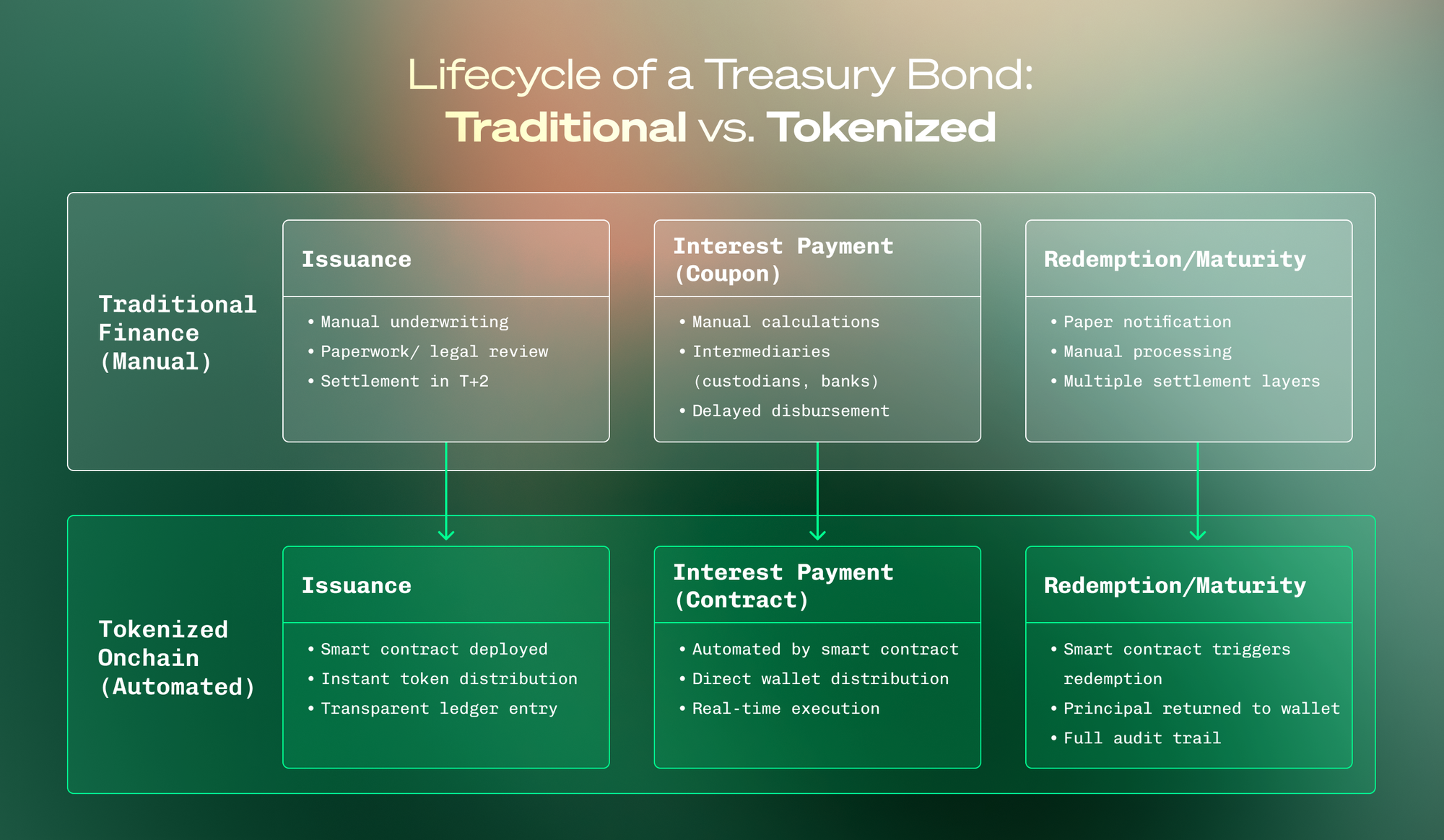

When Your Assets Become Intelligent: The Programmability Revolution

Perhaps we’ve automated bill payments for businesses, but have you considered what happens when actual assets become programmable? This represents the true revolution of RWAs—assets that automatically execute complex financial functions through smart contracts. Consider these emerging capabilities:

- Dividend distributions that execute instantly upon corporate declaration

- Cross-border settlements that occur without currency conversion delays

- Ownership records that remain transparent and immutable

- Financial products that interact autonomously with other on-chain services

We're not merely digitizing assets; we're fundamentally enhancing their functionality through programmable capabilities.

From Theory to Practice: The Emerging Reality

The efficiency gains from RWAs aren't theoretical projections—they're already demonstrating measurable advantages:

- BlockTower Credit's fund on Centrifuge demonstrated a 97% reduction in securitization costs

- Anemoy Liquidity Network enables $125 million in instant redemptions for tokenized Treasury products

- Backed Finance's tokenized S&P 500 (bCSPX) provides permissionless global access to U.S. equity markets

- Tokenized Treasury products allow stablecoin holders to earn ~4.5% yields instead of zero

What happens when these efficiency improvements scale across the entire financial system? The current $15.2 billion RWA market represents just the opening chapter of what could become a multi-trillion-dollar transformation.

An Inflection Point: We are Witnessing Finance's Fundamental Redesign

When BlackRock CEO Larry Fink states that "the next generation of markets, the next generation of securities, will be tokenization," it signals how mainstream this concept has become. The Boston Consulting Group projects up to $16 trillion in tokenized assets by 2030, while the World Economic Forum estimates tokenization could account for 10% of global GDP by 2027.

But these projections may actually underestimate the transformation ahead. As regulatory frameworks mature and institutional adoption accelerates, we're likely witnessing the early stages of a fundamental shift in how assets are issued, traded, and managed globally.

The strategic question for forward-looking institutions isn't whether to engage with this transformation, but how to position themselves to capture first-mover advantages in operational efficiency, liquidity management, market access, and technological leadership. We firmly believe that those who strategically align at this intersection will define the architecture of 21st-century finance.