Traditional Finance Will Drive DeFi Adoption, Not Be Replaced By It

How institutional capital flow is reshaping the blockchain ecosystem and what it means for the future of finance

Introduction

In the early days of blockchain technology, a compelling narrative emerged: decentralized finance (DeFi) would disrupt and eventually replace traditional financial institutions (TradFi). This view positioned banks and financial incumbents as dinosaurs awaiting extinction.This narrative, misses a more nuanced reality: traditional financial institutions will not be replaced by DeFi—they will become its largest users. We are entering an era of convergence where TradFi and DeFi will integrate, creating an ecosystem that leverages the strengths of both worlds.

The Evolution of Financial Infrastructure

Financial infrastructure has never been static. From double-entry bookkeeping in Renaissance Italy to computerized stock exchanges, finance has continually reinvented its machinery while preserving core functions: facilitating exchange, providing credit, managing risk, and storing value.Blockchain introduces distinct capabilities: programmatic value transfer, automated enforcement, transparent verification, and disintermediated settlement. DeFi emerged not to fulfill different functions, but to fulfill the same functions more efficiently and with fewer gatekeepers. As DeFi matures, the narrative has shifted from "replacement" to "integration" because the greatest potential lies not in creating parallel systems, but in improving existing ones.

Why TradFi Needs DeFi

Traditional financial institutions face several challenges that DeFi technology can address:

Operational Efficiency: Legacy systems rely on complex intermediary networks creating significant costs. According to a 2022 Accenture report, banks spend approximately $270 billion annually on compliance alone. DeFi protocols operate on shared ledgers, eliminating much of this friction.

Access to New Markets: Traditional finance struggles with cross-border services where regulatory differences create barriers. DeFi protocols provide access to global liquidity pools through borderless operation.

Settlement Efficiency: Traditional settlement often operates on T+2 timeframes, tying up capital. DeFi enables near-instant settlement, freeing capital and reducing risk.

Competitive Pressure: Financial institutions face pressure from fintech innovators and must adapt by integrating DeFi capabilities.

Evidence of the Convergence Already Underway

This is not merely theoretical—we're already seeing significant moves by traditional financial institutions into the DeFi space:

Institutional DeFi Participation

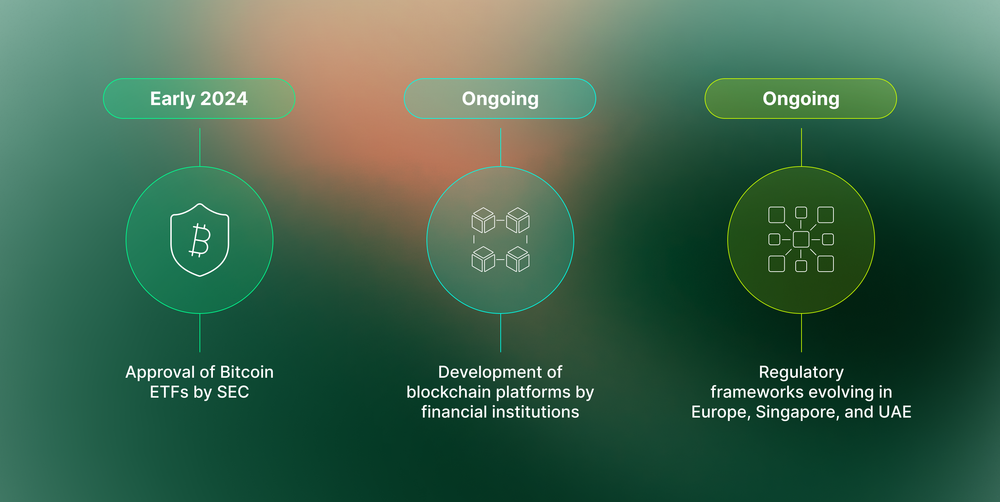

Major financial institutions like JPMorgan, Goldman Sachs, and BlackRock have moved beyond exploratory blockchain projects to active participation in digital asset markets. Financial institutions are developing blockchain-based platforms for wholesale payments using distributed ledger technology to improve settlement efficiency, while asset management firms have created spot Bitcoin private trusts for institutional clients.

Regulatory Developments

Regulatory frameworks are evolving to accommodate institutional participation in digital asset markets. The approval of Bitcoin ETFs by the U.S. Securities and Exchange Commission in early 2024 marked a watershed moment, providing regulated vehicles for traditional finance to gain exposure to digital assets.In Europe, the Markets in Crypto-Assets (MiCA) regulation provides clarity for institutions wishing to engage with digital assets, while jurisdictions like Singapore and the UAE have developed comprehensive frameworks specifically designed to enable institutional participation.

The Rise of Real World Assets (RWAs)

Perhaps the clearest indicator of TradFi embracing DeFi infrastructure is the rapid growth of tokenized real-world assets (RWAs). Unlike purely on-chain assets, RWAs represent tokenized versions of traditional financial instruments like treasury bills, corporate bonds, real estate, and private equity.According to industry data, the total value of tokenized real-world assets has already surpassed $20 billion as of early 2025, growing at a rate that exceeds early DeFi growth. This is significant because RWAs represent existing TradFi products being brought onto blockchain infrastructure—a clear example of traditional finance utilizing DeFi technology rather than being replaced by it.

Case Study: Fixed Income Tokenization

A particularly instructive example comes from the fixed income market. Several institutions, including major banks and asset managers, have begun tokenizing money market funds and treasuries, enabling these traditional instruments to be used within DeFi protocols.This allows the yield from these traditional assets to be integrated into DeFi applications, creating a hybrid product that combines the risk profile and regulatory compliance of traditional assets with the programmability and efficiency of DeFi infrastructure.

Bridging Traditional and Decentralized Systems

The essential bridge between traditional finance and decentralized protocols is reliable data infrastructure. Financial institutions require verified information to flow securely between their existing systems and blockchain networks.This critical infrastructure supports real-time asset pricing, identity verification, regulatory compliance, and secure transaction validation across both worlds, enabling the seamless operation of tokenized assets.

The Path Forward: Collaboration, Not Competition

The future of finance is a hybrid model combining the strengths of both approaches. Traditional institutions bring regulatory compliance, customer relationships, risk management expertise, and capital. DeFi protocols bring efficiency, transparency, programmability, and accessibility.By viewing this relationship as collaborative rather than competitive, both sectors can thrive in a converging ecosystem that better serves both institutional and individual needs.

EO's Role in the Convergent Future

As finance evolves toward convergence, EO sees its position as critical and is committed to providing the data infrastructure that bridges traditional finance and decentralized protocols, enabling the trust necessary for institutional adoption of blockchain technology.Our approach meets the stringent requirements of regulated financial institutions while preserving the core benefits of decentralized systems, creating the foundation for a truly converged financial ecosystem.

Conclusion: The Internet of Contracts

Just as the internet evolved from being defined by email to encompassing all information technology, blockchain is evolving from cryptocurrencies to an "internet of contracts"—a global system for programmatically executing agreements and transferring value.In this evolution, traditional financial institutions won't be displaced; they'll be transformed. By adopting DeFi infrastructure, these institutions will drive a new wave of financial innovation that combines the best of both worlds—more efficient, accessible, and transparent, yet compliant with necessary regulations.

The Roadmap:

References and Sources

- Markets in Crypto-Assets (MiCA) Regulation, European Commission (2023)

- ["Blockchain in Capital Markets: The Prize and the Journey," McKinsey & Company (2023)](https://www.mckinsey.com/industries/financial-services/our-insights/beyond-the-hype-blockchains-in-capital-markets?)

- "Policy Recomendations for Crypto and Digital Asset Markets” (IOSCO) (2024)

- ["The Future of Financial Infrastructure," World Economic Forum (2023)](https://www3.weforum.org/docs/WEF_The_future_of_financial_infrastructure.pdf?)