Which RWA Classes are Leading the Revolution? (The Top 7 Industries)

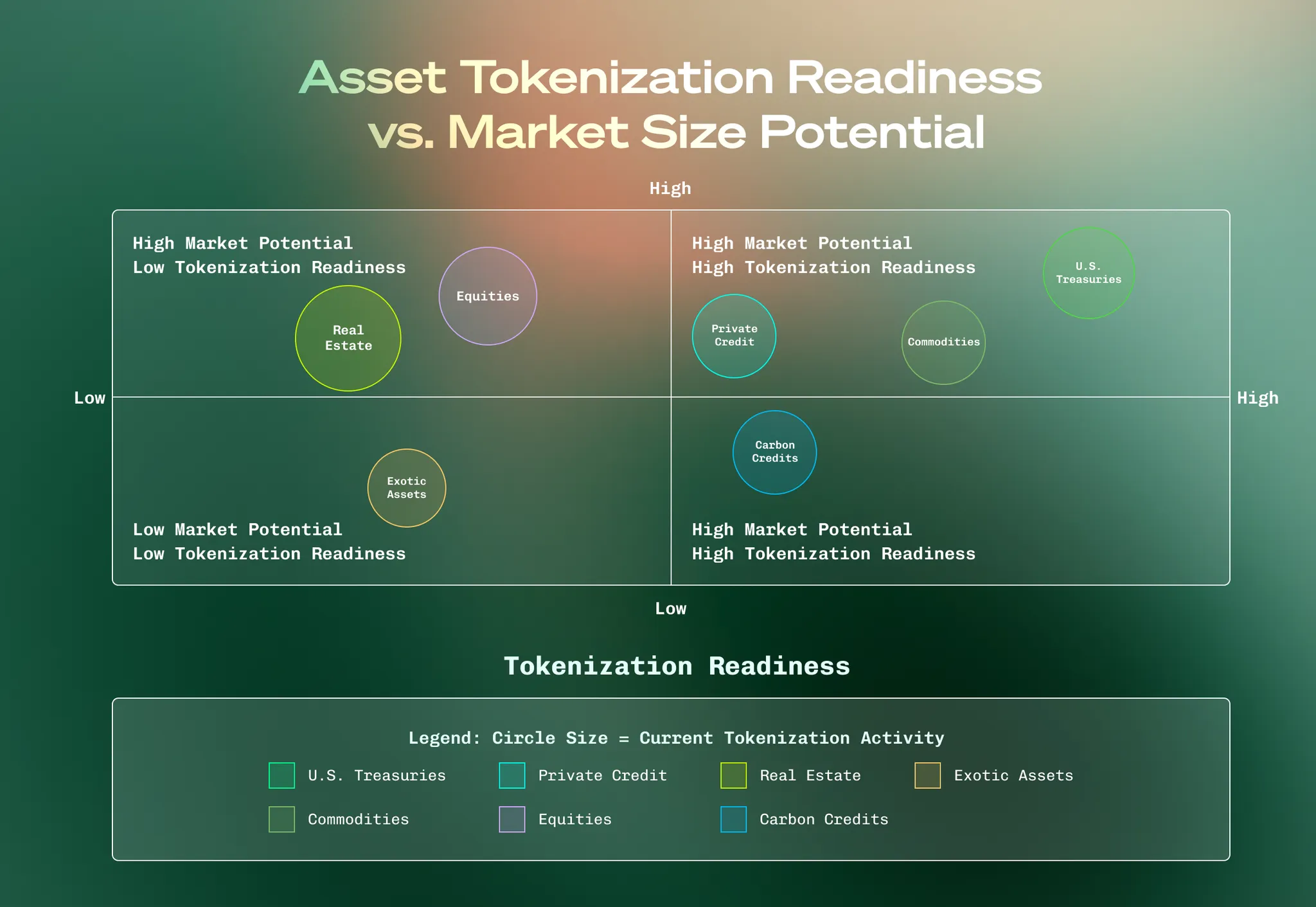

The tokenization of real-world assets is progressing at different rates across various asset classes. This uneven adoption presents important strategic considerations for investors, issuers, and infrastructure providers in this evolving market. This article examines the current state of tokenization across major asset classes, analyzing why certain assets are tokenizing more readily than others and what this means for the future of financial markets.

U.S. Treasuries - The Current Leader

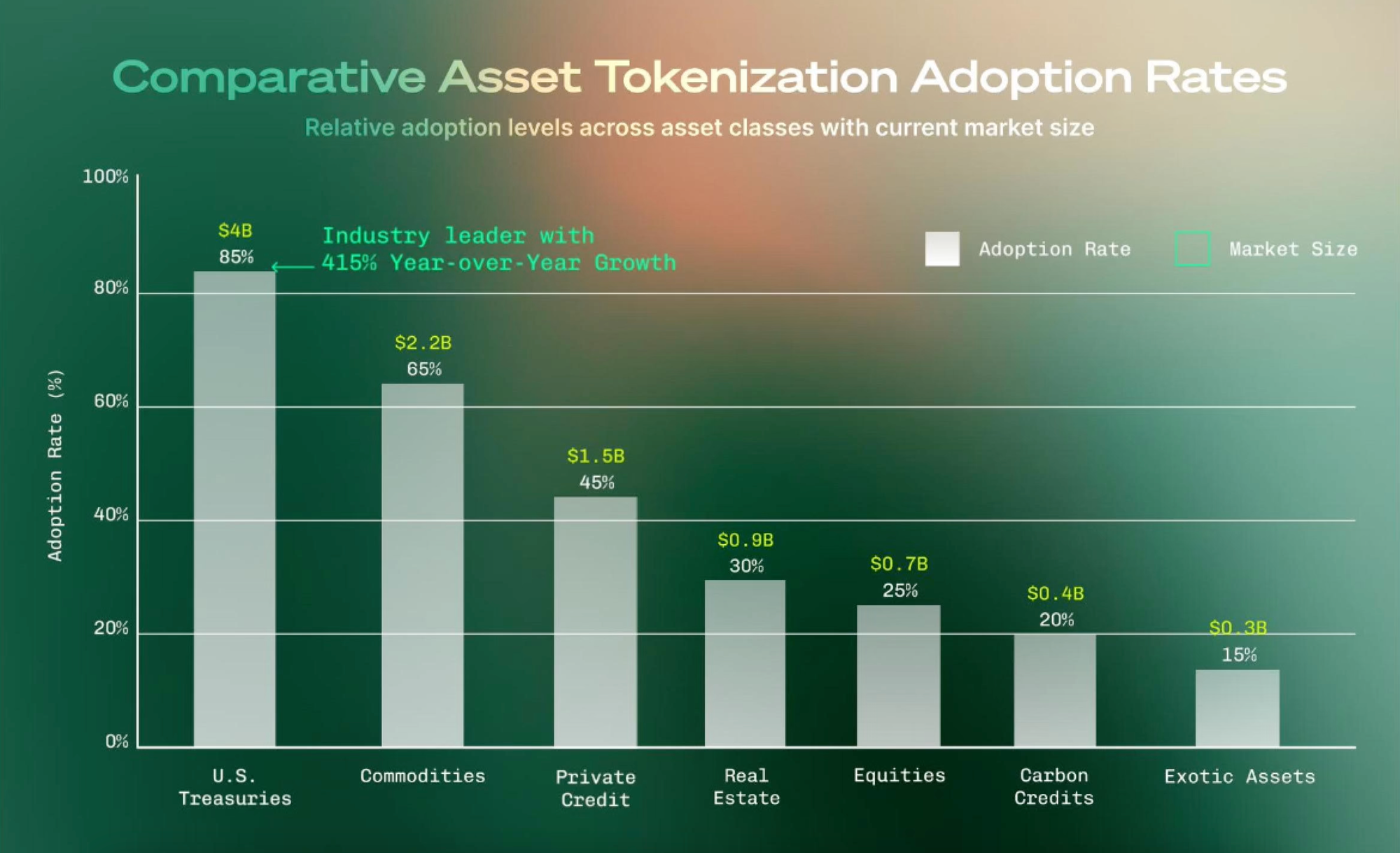

U.S. Treasuries have emerged as the frontrunner in the tokenization revolution, with growth that has exceeded market expectations. Tokenized treasury products have grown from $800 million to $4 billion in just one year, representing a remarkable 415% year-over-year growth rate.

This rapid adoption can be attributed to several key factors:

- Regulatory Clarity: U.S. Treasuries operate within a well-established regulatory framework, making them relatively straightforward to tokenize in a compliant manner.

- Institutional Comfort: Traditional financial institutions are already deeply familiar with Treasury securities, reducing the educational barrier to adoption.

- Yield Advantages: Tokenized treasuries often offer yield improvements over traditional treasury holdings, particularly for digital asset holders seeking to move from zero-yield positions.

- Settlement Efficiency: The traditional Treasury market's T+1 settlement cycle creates inefficiencies that tokenization directly addresses through near-instant settlement.

Major asset management firms have begun creating tokenized treasury products that maintain institutional-grade security while offering the efficiency benefits of blockchain technology.

Looking ahead, tokenized treasuries are projected to continue their rapid growth trajectory, potentially reaching $10-15 billion by the end of 2025 as more institutional players enter the market and existing offerings scale.

Commodities - Unique Approaches and Challenges

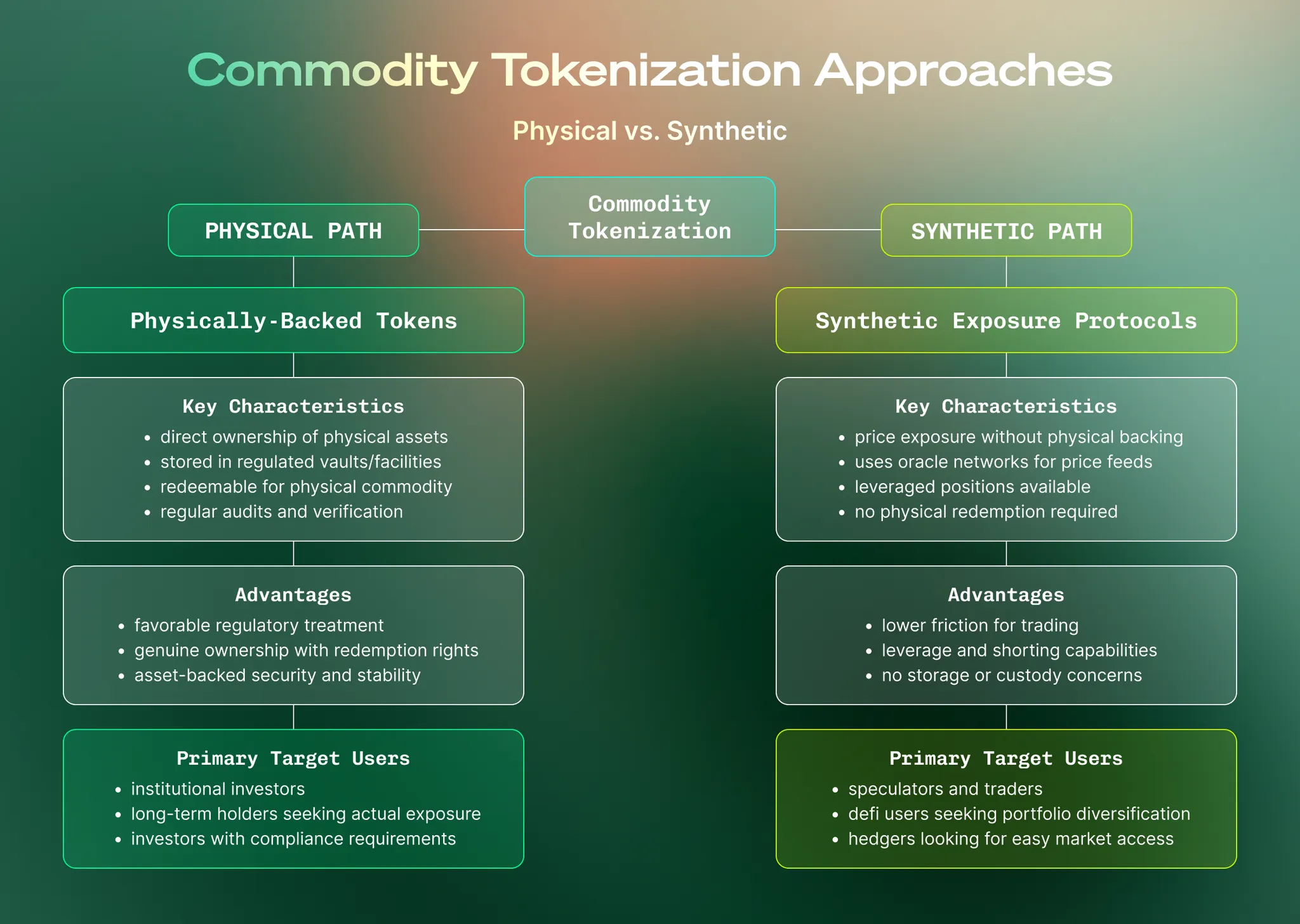

Commodities represent a fascinating case study in tokenization, with approaches varying significantly based on the specific commodity and target market. The tokenization of commodities broadly falls into two categories: physically-backed tokens and synthetic exposure.

Physically-backed tokens represent direct ownership of a specific commodity stored in regulated vaults. These tokens benefit from a unique regulatory advantage: owning a bar of gold or a barrel of oil is typically considered a commercial transaction rather than an investment contract, avoiding many of the regulatory hurdles that apply to securities.

This regulatory distinction allows tokenized commodities to operate under frameworks that emphasize custodianship and physical asset transparency rather than the comprehensive investor protections required for securities. Industry implementations demonstrate how tokenized commodities can represent direct ownership of standardized, audited assets while sidestepping issues such as corporate voting rights or integration with centralized depositories.

An alternative direction is emerging through purely synthetic commodity exposure that forgoes physical redemption entirely. Advanced DeFi protocols enable users to go long or short on gold and other commodities with margin, referencing off-chain spot prices through decentralized blockchain oracle networks.

This approach addresses the demand gap among traders who find physically redeemable tokens cumbersome, preferring instead the speculative and leveraged aspects of commodity trading.

The future of commodities tokenization likely involves both approaches expanding in parallel, serving different market segments: physically-backed tokens for institutions seeking actual commodity exposure, and synthetic protocols for traders focused on price speculation.

Private Credit - The Next Frontier

Private credit is emerging as one of the most promising frontiers for tokenization, with significant growth potential in the coming years. Traditional private credit markets suffer from inefficiencies that tokenization directly addresses: limited liquidity, high minimums, and manual processes.

The tokenization of private credit offers several compelling advantages:

- Improved Liquidity: By enabling fractional ownership and secondary trading, tokenization can bring liquidity to traditionally illiquid credit instruments.

- Lower Minimums: Fractional ownership allows smaller investors to access private credit markets previously reserved for large institutions.

- Automated Administration: Smart contracts can automate interest payments, covenant monitoring, and other administrative functions.

- Transparent Performance: On-chain data provides real-time visibility into loan performance and payment history.

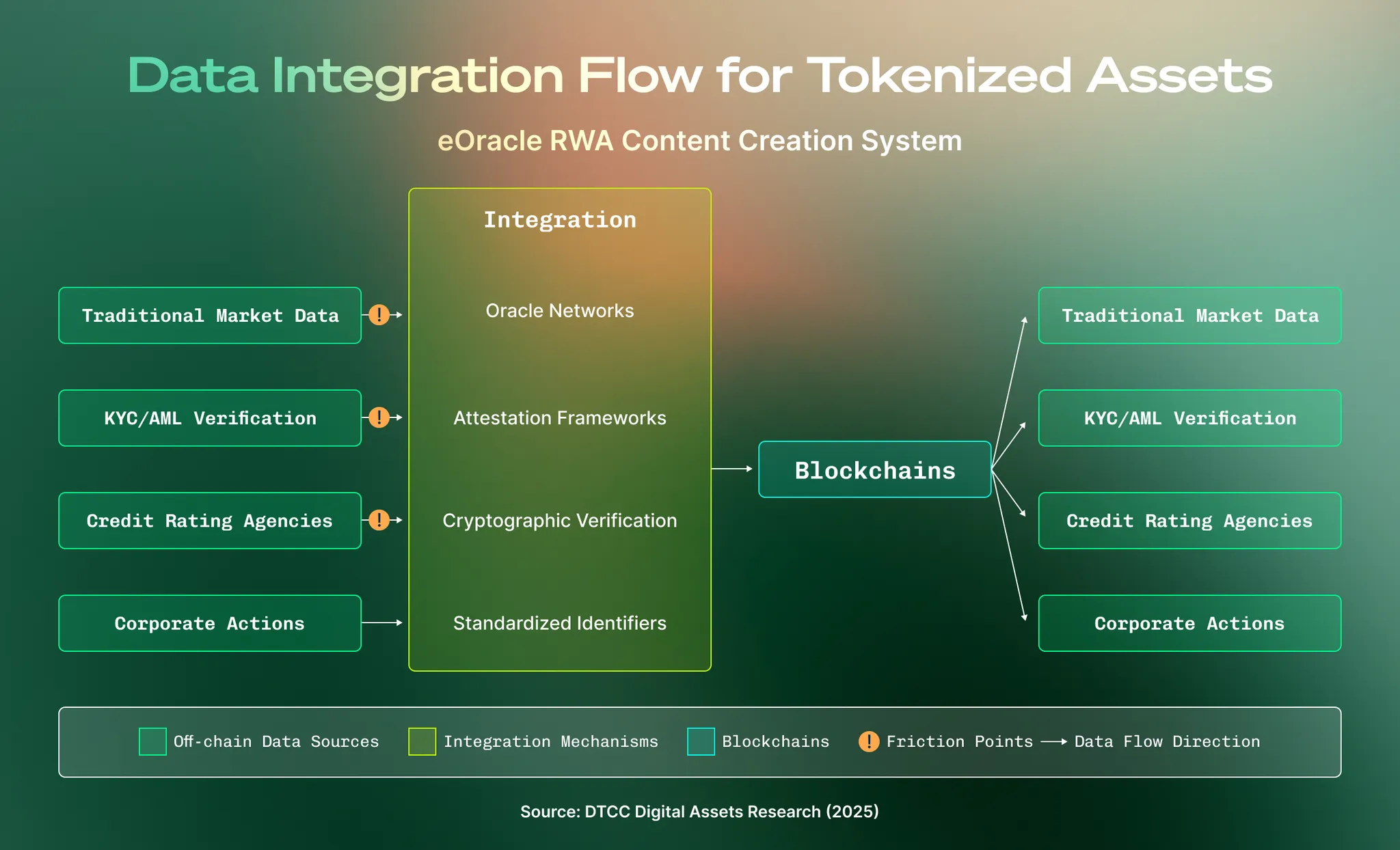

Various industry platforms have been pioneering in this space, tokenizing various forms of private credit from invoice factoring to mortgage loans. EO's decentralized infrastructure provides the secure data connections necessary for these private credit applications to operate effectively.

The private credit tokenization market is still relatively small compared to treasuries, but it's growing rapidly as more originators and investors recognize the efficiency gains. Current estimates suggest the market could reach $5-7 billion by 2026, representing significant growth from current levels.

Equities, Real Estate, and Beyond

Beyond treasuries, commodities, and private credit, several other asset classes are at various stages of the tokenization journey:

Equities

Equity tokenization faces some of the most significant regulatory hurdles, particularly around shareholder rights, corporate actions, and secondary trading. Current approaches range from fully-regulated security tokens to synthetic equity exposure through tokenized derivatives.

The proposed "Broker-Dealer Tokenization Act" in the U.S. aims to address these challenges by giving broker-dealers explicit authority to issue and trade tokenized securities on distributed ledgers. By classifying 'qualified tokenized securities' and allowing 'approved broker or dealer' designations for those meeting custody, disclosure, and operations criteria, the bill could smooth the legal path for legitimate tokenized equity markets.

While progress has been slower than in other asset classes, the potential market for tokenized equities is enormous, potentially representing trillions of dollars in value as regulatory frameworks mature.

Real Estate

Real estate tokenization promises to unlock the world's largest asset class (estimated at $280 trillion globally) through fractional ownership and improved liquidity. Current tokenization efforts focus primarily on commercial properties and real estate investment trusts (REITs), with residential properties presenting additional complexity.

The challenges in real estate tokenization include:

- Legal Frameworks: Real estate ownership involves complex legal structures that vary by jurisdiction.

- Valuation Complexity: Unlike publicly traded securities, real estate requires specialized valuation methods.

- Management Rights: Clarifying how property management decisions are made when ownership is fractional.

Despite these challenges, real estate tokenization is progressing steadily, with several successful projects demonstrating the viability of the model. The market is expected to grow significantly as legal frameworks adapt to accommodate tokenized property ownership.

Carbon Credits and ESG Assets

An emerging area of interest is the tokenization of carbon credits and other environmental, social, and governance (ESG) assets. Blockchain's transparency can help solve verification and double-counting problems that plague traditional carbon markets.

Projects focusing on tokenized carbon credits aim to create more liquid and transparent markets for environmental assets, potentially accelerating climate finance by making these instruments more accessible to a broader range of investors. Reliable blockchain oracle networks play a crucial role in verifying real-world environmental impact data that underlies these tokenized assets.

Exotic Assets

Beyond traditional financial assets, tokenization is extending to more exotic categories like art, collectibles, and intellectual property rights. These assets benefit particularly from tokenization's fractional ownership capabilities, potentially democratizing access to previously exclusive investments.

While currently a small portion of the overall tokenization landscape, these exotic asset categories represent significant long-term potential as the infrastructure for non-financial asset tokenization matures.

Conclusion

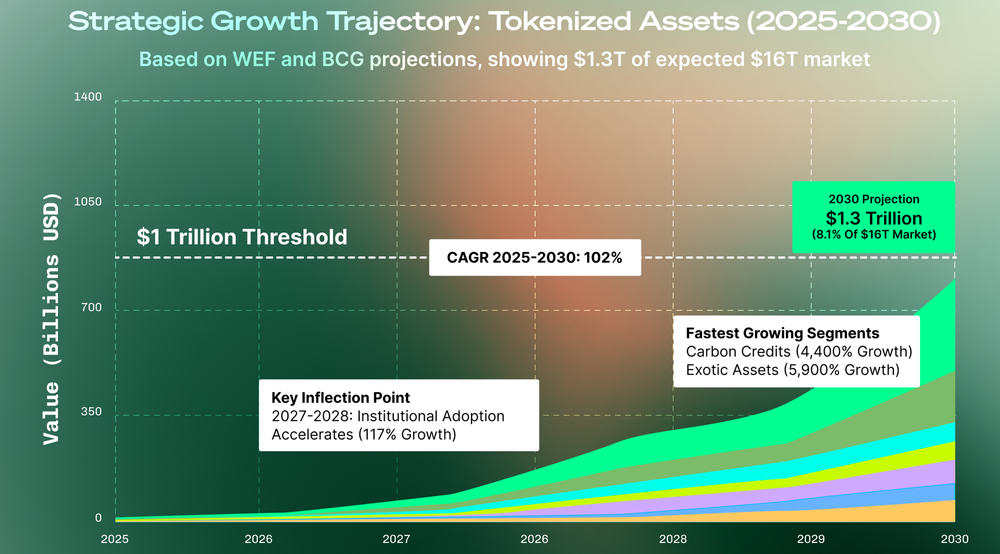

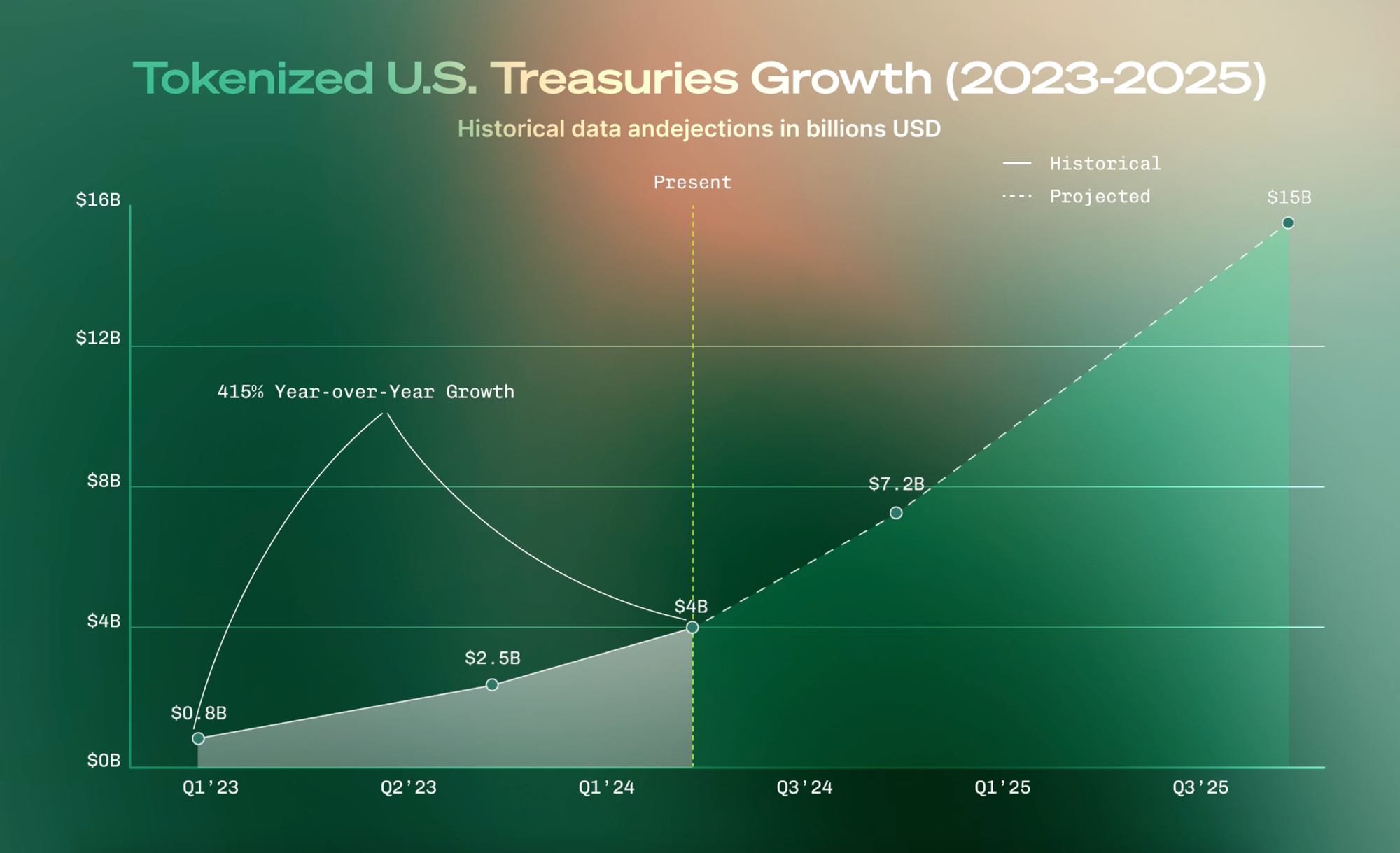

The tokenization revolution is following a logical progression: starting with the simplest, most regulated assets (digital currencies and treasuries) before expanding to more complex ones. This pattern mirrors previous financial innovations, where adoption begins in the most liquid and transparent markets before spreading to more specialized niches.

For investors looking to participate in this transformation, understanding the varying adoption rates across asset classes provides crucial strategic insights. U.S. Treasuries offer the most mature tokenized market today, with established products from major financial institutions. Commodities provide unique regulatory advantages and multiple approaches to suit different investor needs. Private credit represents a high-growth frontier with significant efficiency gains. Other asset classes, while earlier in their tokenization journey, offer substantial long-term potential as regulatory and technical hurdles are addressed.

EO's decentralized data infrastructure provides the critical foundation for secure, reliable tokenization across all these asset classes, ensuring price data, market events, and regulatory compliance can be reliably verified on-chain.

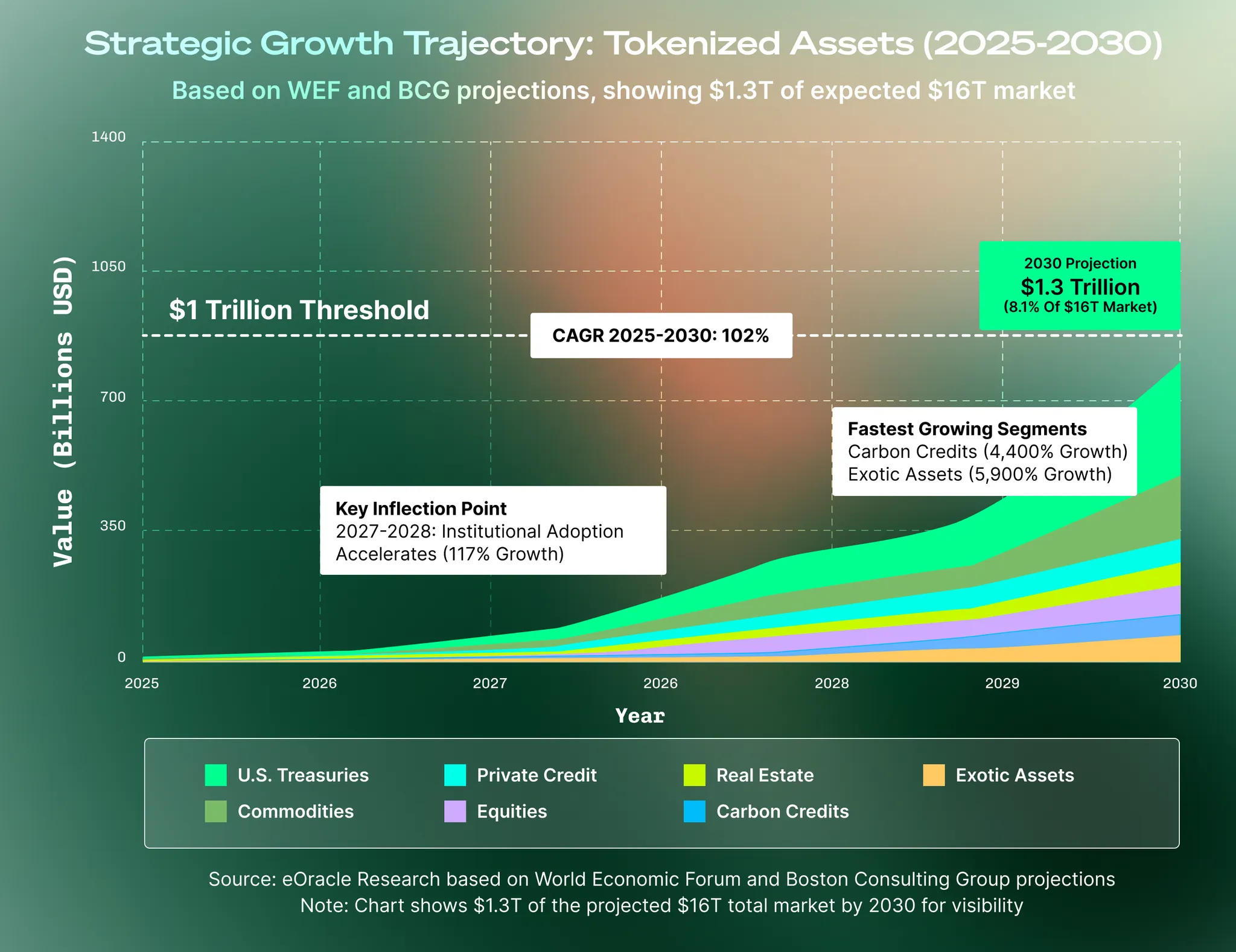

As the World Economic Forum estimates tokenization could account for 10% of global GDP by 2027, with Boston Consulting Group projecting up to $16 trillion in tokenized assets by 2030, the opportunity across this spectrum of asset classes is substantial. The question for market participants is not whether tokenization will transform financial markets, but which assets will lead the next wave of adoption and how to position accordingly.